Share

China’s economic ties with Africa have grown significantly since the early 2000s. China is currently the largest bilateral trading partner and top export destination for most countries in Africa, and since 2013, China has become the largest bilateral provider of foreign direct investment (FDI) to Africa.

However, China’s deepening economic connections and investment flows to Africa have been the subject of discussion regarding their composition, intent and the perceived trade-offs of benefits to risks with potential long-term implications for the continent’s local industrial development, upgrading and sustainable economic transformation.

Our new working paper published by the Boston University Global Development Policy Center explores the dynamics of Chinese FDI in Africa, particularly focusing on how Chinese FDI impacts low-carbon industrialization in Africa. Furthermore, we examine the impact of Chinese FDI on carbon intensity of Africa’s industrialization, with a focus on sectoral heterogeneity and the role of environmental regulations in moderating the outcome. We also compare Chinese investments with those from Organization for Economic Co-operation and Development (OECD) countries and discuss strategies for achieving sustainable industrialization in Africa through FDI.

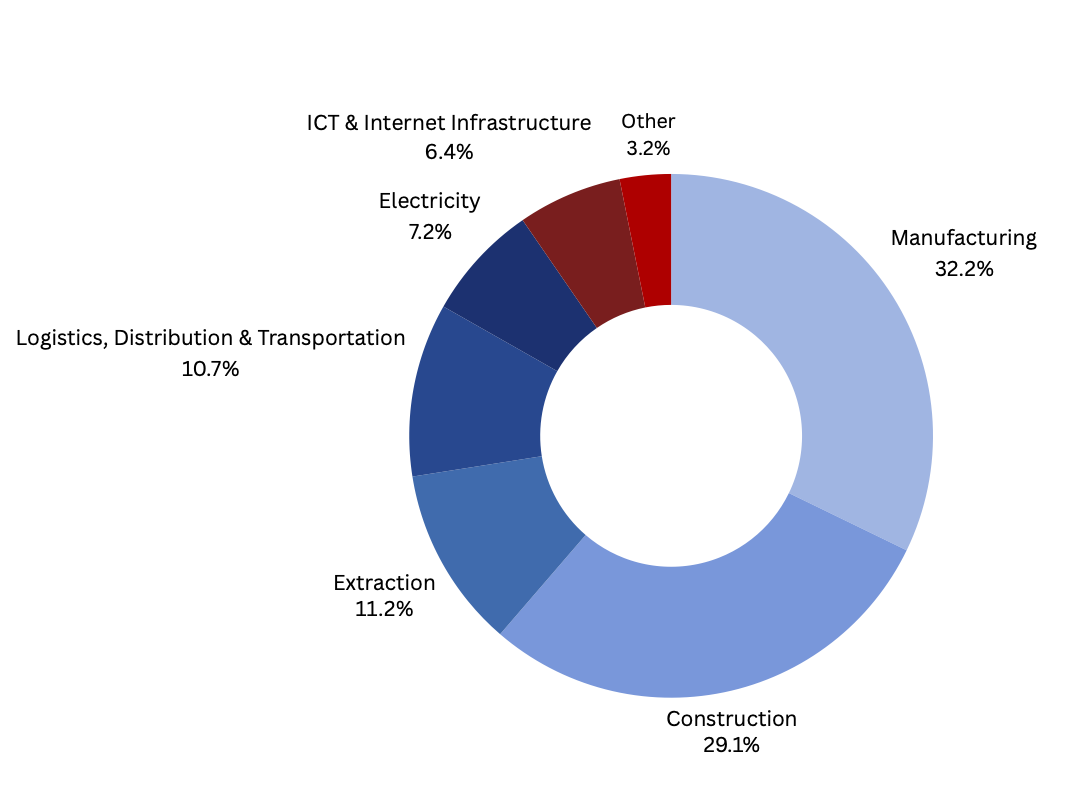

Our evaluation of the pattern of China’s FDI into Africa reveals a concentration in light manufacturing, natural resource extraction, construction sectors with a smaller share allocated to knowledge-intensive sectors, as illustrated in Figure 1. We also find that Chinese FDI is associated with a significant increase in industrial carbon emissions, whereas this is not the case when the FDI is sourced from countries within the OECD. Results of the environmental regulation analysis complement this analysis, providing suggestive evidence of the role for environmental regulation in many African countries in affecting these outcomes.

Figure 1: Chinese FDI to Africa, by Sector, 2003-2022

Figure 1: Chinese FDI to Africa, by Sector, 2003-2022

Knowledge-intensive sectors show promise over in labor and resource-intensive sectors

The study, which examined Chinese FDI in 34 African countries from 2003-2014, found that these investments are contributing to increased industrial carbon emissions in Africa. This effect is particularly pronounced when FDI is channeled into labor-intensive and resource-intensive sectors. This trend aligns with previous research on Chinese investment in other developing regions, which has often focused on extractive industries and light manufacturing. While these investments can bring much-needed jobs and economic growth, they also risk locking African countries into carbon-intensive development pathways.

However, we found no significant increase in emissions when Chinese FDI is channeled into knowledge-intensive manufacturing sectors. The findings highlight the complex interplay between Chinese economic engagement and environmental outcomes in Africa. It also suggests that investments in high-tech industries and research and development have the potential to support more sustainable industrialization in Africa.

The role of environmental regulations

The research also highlights the role that environmental regulations could play in shaping the impact of foreign investment on the environment. In the study, countries with stronger environmental regulations tend to see lower increases in emissions from Chinese FDI, although this effect was not statistically significant. We attribute this largely to a lack of effective enforcement of environmental regulation or the presence of weak regulatory institutions more broadly across the African continent.

Our findings demonstrate that stronger environmental regulations in recipient countries can moderate the impact of Chinese FDI on industrial carbon emissions, underscoring the crucial role of regulatory frameworks. This emphasizes the necessity for sustainable development strategies and robust regulatory frameworks to effectively address environmental challenges.

A global comparison

It is worth noting that the industrial carbon emissions impact of Chinese FDI appears to be distinct from that of other major investors in Africa. We found no statistically significant increase in emissions from FDI originating in OECD countries, despite similar concentrations in resource-intensive sectors.

The study infers that this discrepancy may be due to differences in the implementation of environmental, social and governance (ESG) standards. While China has made recent strides in promoting green development through initiatives like the Belt and Road Initiative, it is important to note that our analysis covers the period 2003-2014, before these commitments were made. Therefore, the actual on-the-ground implementation of these standards in overseas investments during the study period may not reflect the more recent improvements in China’s green development initiatives.

Balancing growth and sustainability in Africa

The success of Africa’s industrialization prospects hinges on adeptly managing the climate transition. Despite contributing about 4 percent to total global emissions, the region grapples with a disproportionately high level of climate risks. A staggering 95 percent of agriculture in Africa depends on rainfall, accentuating vulnerability due to the sector’s substantial contribution to regional employment and gross domestic product (GDP). Furthermore, evolving consumer preferences in key export markets towards sustainable products and the increasing mainstreaming of environmental provisions in trade agreements present a formidable challenge for Africa’s exports, which are largely commodities exports.

The shift to low-carbon industrialization presents a unique opportunity for Africa to invest in climate-smart manufacturing. This strategic pivot away from commodity dependence could pave the way for enhanced competitiveness, efficiency and the creation of higher value-added products. Moreover, the transition to low-carbon industrialization is a costly endeavor and requires substantial investments in capabilities to ensure competitiveness. Many African nations find themselves grappling with a transition lag, both in terms of infrastructure, capabilities and fiscal constraints hindering the financing of this transformative process. In this context, FDI from China assumes significant relevance, given China’s ascension as the world’s largest bilateral FDI investor to Africa.

Chinese investment has been a major driver of economic growth and industrialization across the continent. The associated increase in industrial carbon emissions found in our study threatens to undermine global climate goals and could expose African countries to future economic risks as the world transitions to a low-carbon economy.

To address these challenges, a multi-pronged approach is needed. First, African governments should prioritize the development and enforcement of robust environmental standards to ensure foreign investments align with sustainability goals. Strengthening environmental regulations will be crucial in mitigating the adverse impacts of industrial activities.

Second, encouraging investment in high-tech and innovative industries can help African countries leapfrog to more sustainable development pathways. Focusing on knowledge-intensive sectors could include providing tax breaks for green investment in innovative and low-emission industries, thereby fostering more sustainable economic growth.

Third, facilitating the transfer of clean technologies and best practices from Chinese firms to local African businesses can help build domestic capacity for low-carbon industrial activities. Promoting technology transfer will be essential in equipping local industries with the necessary tools for sustainable industrial development.

Finally, improved data collection and reporting on the environmental impacts of foreign investments can help inform policy decisions and hold investors accountable. Enhancing monitoring and transparency will ensure that the environmental consequences of foreign investments are adequately tracked and addressed.

Addressing the aforementioned challenges is critical for the future of Africa’s industrialization and environmental sustainability. The decisions made today will determine whether Africa can forge a partnership that balances economic growth with environmental stewardship. This will not only address the pressing challenge of low-cardon industrialization and climate change, but position Africa at the forefront of the global green economy, setting a powerful example for sustainable development in the Global South.

Source: https://www.bu.edu/

You Might also Like